Five sectors anticipating growth

Travel and tourism, and manufacturing

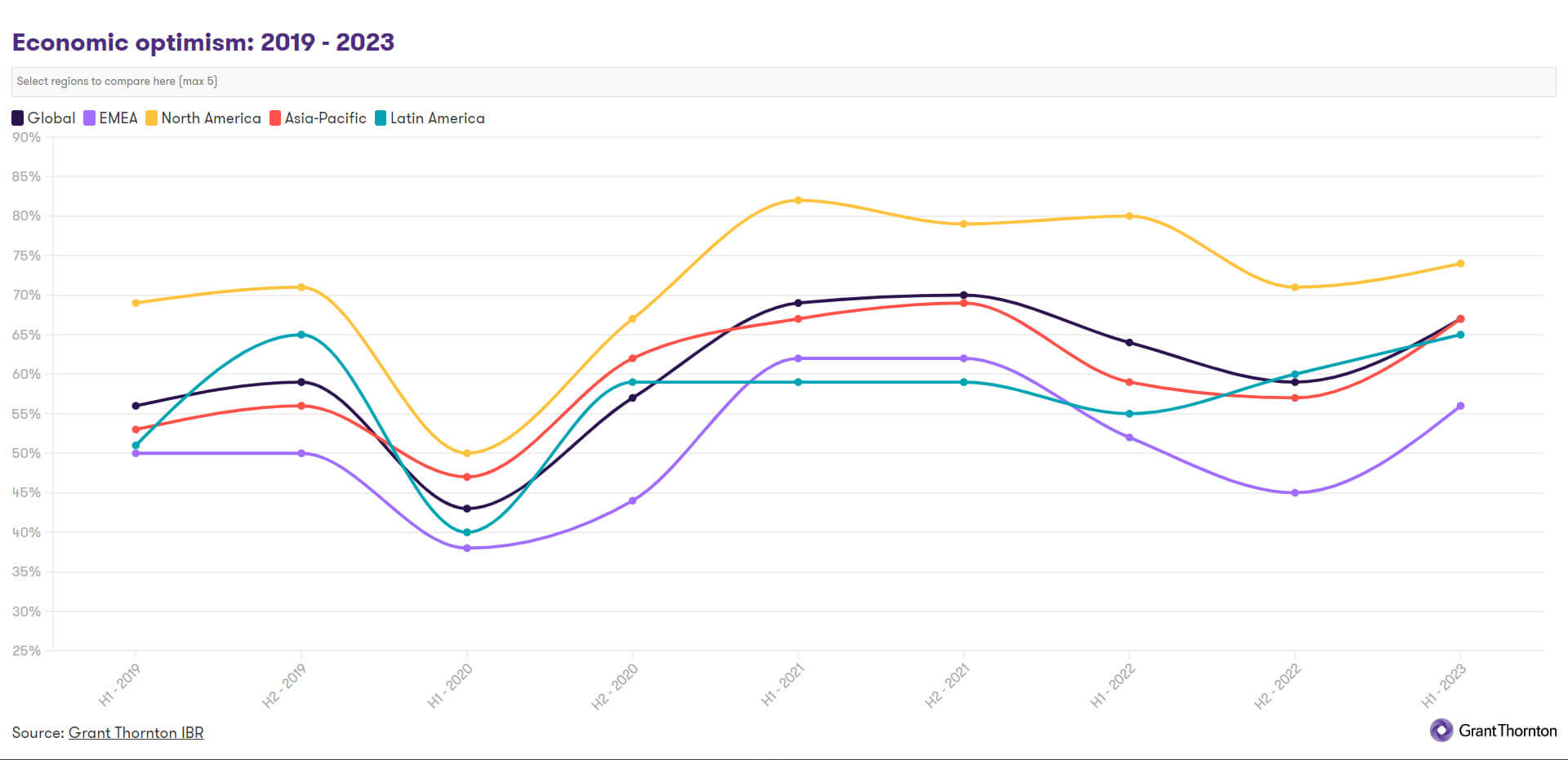

Optimism is up across the board, but there are some sectors which feel particularly positive. Firms in the travel and tourism sector were among the hardest hit by the pandemic, as travel restrictions made tourism largely impossible. The sector only partially recovered in 2021 and 2022 but has since seen its optimism figures rebound. At the end of 2022, just under half (48%) of mid-market firms in this sector were optimistic about their prospects. Now, two in every three firms (66%) are optimistic.

Likewise, two in three (66%) mid-market firms in the manufacturing sector are optimistic about the year ahead. This is up 10 percentage points compared to the last set of data from the end of 2022. The positivity among these firms will reflect stabilising energy costs and confidence in the robustness of supply chains, and their ability to create additional value here, as trade disruptions ease. At the same time, firms that are able to benefit from increased investment in clean tech, such as semiconductors, electric vehicles, batteries and solar and wind parts, will be feeling more upbeat given significant investment in these technologies. For example, in the US, the IRA and the Chips Act have prompted a $220bn cleantech project boom, with more than 110 large-scale manufacturing announcements.[v] While other regions may find it difficult to compete with the scale of funding seen in the US, mid-market firms in these industries will benefit from increased investment around the world.[vi]

Oil and gas

The oil and gas industry, however, is the most optimistic, with a startling 86% of mid-market firms feeling positive about their prospects for the year ahead, up 30% from last half. The sector’s optimistic outlook follows a period of bumper profits caused by shifts in the energy sector. However, this has also brought about increased scrutiny, especially considering concerns about consumers’ energy bills, and there will be greater interest in how these firms invest the profits they’ve made, with expectations that it should be used for new projects, including clean energy.

![]() “We have experienced consistently higher prices of oil and gas in the last twelve to eighteen months, maybe longer. As a result, you're seeing mid-market energy companies with greater confidence in their deployment of capital, reinvestment, and hiring people. They can plan with confidence a number of different activities, all aligned with their strategy for the future.

“We have experienced consistently higher prices of oil and gas in the last twelve to eighteen months, maybe longer. As a result, you're seeing mid-market energy companies with greater confidence in their deployment of capital, reinvestment, and hiring people. They can plan with confidence a number of different activities, all aligned with their strategy for the future.

“So, I think that is really the backstory to the optimism in the energy sector right now. Prices have been very good relative to historic levels. That allows mid-market energy to invest in a range of activity to advance their businesses and to generate profits and returns for investors.” - Bryan Benoit, Global head of energy and natural resources and Global co-leader valuation services, Grant Thornton US.

Financial services

Emerging from the post-pandemic rebound, the financial services sector continues to show high levels of optimism, with 74% of firms positive about their outlook, up from the 70% reported six months ago. The growth in optimism is likely to have been prompted by increased interest rates leading to greater returns. Equally, rate changes will be acting as a catalyst, motivating consumers and businesses to revisit their investments and funding structures, creating new opportunities for financial services firms. Rate rises have also had repercussions for consumers though, which is drawing greater attention to firms’ stated commitments to protecting their customers.

Adding to the positive picture for mid-market financial services firms, they are also less concerned about economic uncertainty than they have been in a while, with 58% of firms seeing it as a constraint to their business, materially down from 73% last year.

Technology, media and telecoms

Similarly, optimism in the tech, media and telecoms sector has not fallen much since a peak of 77% in the first six months of 2021, now at 73% in the first half of 2023.

![]() “The technology, media and telecommunications sector is, by its very nature, more disruptive than many other industries. Tech leaders and entrepreneurs are generally more comfortable with a faster pace of change. And also, the sector attracts the kind of people who are inherently more optimistic. They place bigger bets and have more appetite for risk.

“The technology, media and telecommunications sector is, by its very nature, more disruptive than many other industries. Tech leaders and entrepreneurs are generally more comfortable with a faster pace of change. And also, the sector attracts the kind of people who are inherently more optimistic. They place bigger bets and have more appetite for risk.

“The big concern for many mid-market firms in the industry is being too reliant on funding and financing. But, much of that funding tends to be balanced more towards equity than debt. So some of these firms may have been hit less by interest rates when compared to other sectors.

“In the end, business leaders in tech are likely to be optimistic because they know that they have the products and skills that clients need. While so many other industries face existential risks to their business models, tech continues to disrupt and to grow. The development of AI is only going to accelerate that.” - Nick Watson, Partner, Global head of technology, Grant Thornton UK.

![]() “Big tech players are going to be subject to more regulation going forward across Europe and in the US. They will have to be more open and stop some of the anti-competitive practices that they have used to stifle smaller firms up to now. It should allow other businesses to gain market share and have access to the customer base of the tech giants in a way they haven’t before.”

“Big tech players are going to be subject to more regulation going forward across Europe and in the US. They will have to be more open and stop some of the anti-competitive practices that they have used to stifle smaller firms up to now. It should allow other businesses to gain market share and have access to the customer base of the tech giants in a way they haven’t before.”

“This offers big opportunities for mid-market firms in this sector. Hopefully if you can regulate that supply chain, you can get more innovation and entrepreneurialism. More regulation on some of the bigger giants might make it easier for others to gain entry, access those customers, those markets and do business.” - Schellion Horn, Partner, Economic consulting, Grant Thornton UK

Five sectors anticipating growth

The latest IBR data gives an insight into which businesses are most likely to be optimistic about their prospects for the year ahead. Business leaders who are optimistic are those who lead firms which have performed well over the last twelve months. The mid-market firms that have a global outlook and have managed to negotiate recent economic turbulence will be key in helping to drive global recovery in the long term.

![]()

Firms that are optimistic about their outlook, are also much more likely to have positive expectations across the business trends measured. Not only do they expect increases in revenue and profitability, but they also expect to increase their exports, increase investment in IT and skills, and increase staffing levels.

Successful firms have managed to weather recent economic shocks and maintained growth despite difficult market conditions. Their optimism levels have increased as wider concerns about potential recession have withdrawn. Now they are in a position to drive growth despite lingering economic uncertainty.